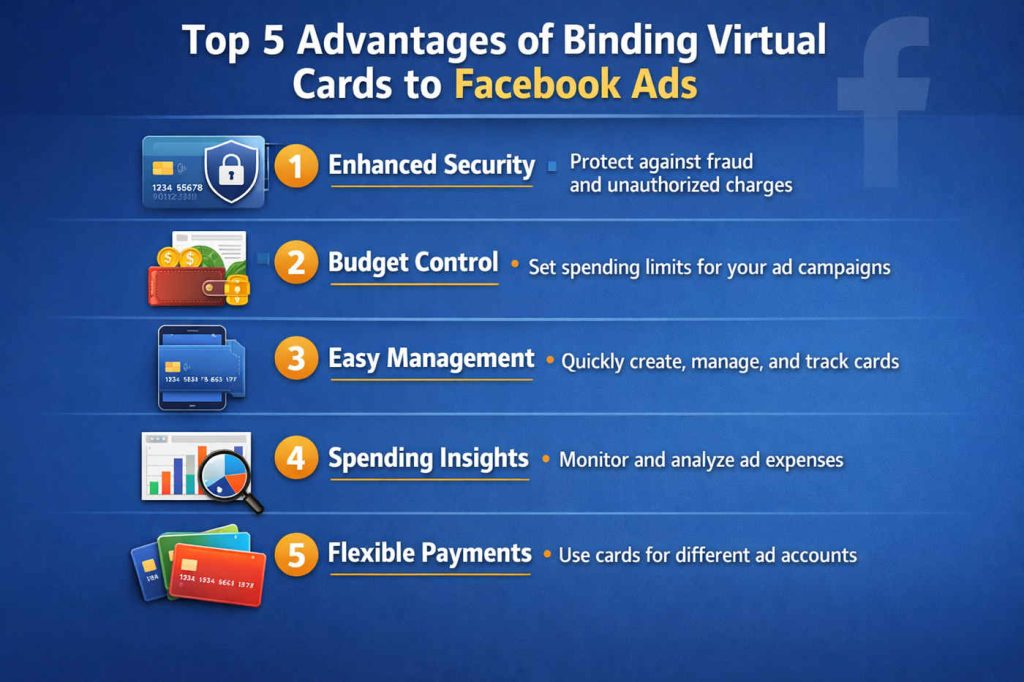

Looking to efficiently manage your budget and minimize account ban risks in Facebook advertising? Virtual cards are a “secret weapon” for digital marketers and cross-border advertisers, especially when running campaigns for international audiences. They help overcome issues like payment restrictions, fraud risks, and more. Here are the 5 core advantages—read on and apply them directly.

- Maximized Payment Security: Protect Against Bans & Fraud Virtual cards aren’t linked to your real credit card details—you can customize the card number, expiration date, and spending limits. If an ad account gets restricted, simply cancel the current virtual card and generate a new one, avoiding the risk of your primary card being flagged by Facebook. Best for: High-volume testing, multi-account operations—spread risks flexibly.

- Precise Budget Control: Say Goodbye to Overspending Worries Issue a separate virtual card for each ad account with a fixed top-up amount (e.g., $100 per card)—spending stops automatically when the balance hits zero. Facebook deducts from the card balance first, preventing unexpected large charges (like a sudden $900 bill). Tips: Top up in small amounts and monitor spend in real-time—perfect for beginners testing creatives.

- Effortless Multi-Account Management: Clear and Traceable Costs One virtual card can be linked to 3-5 Facebook ad accounts, with transaction records syncing instantly. Use dedicated cards for different product lines or regions—financial tracking becomes crystal clear, no more mess from mixing business and personal expenses. Must-know for marketers: Many platforms let you export detailed transaction logs for easy ROI calculations.

- Low Issuance Costs Starting at $2: Low-Risk Testing Typical virtual cards cost just $2 to issue + 3.5% recharge fee (as low as 1%)—if banned, discard with minimal loss. Unlike physical credit cards (which require bank history or credit checks), virtual ones often need only a simple registration (e.g., with a Hong Kong entity), ready in 30 seconds. Pro tip: Some platforms allow custom billing addresses to perfectly match your ad account’s region.

- Avoid “Sunk Costs” from Prepaid Balances: Flexible Loss Control In Facebook’s prepaid mode, unused balance is lost if an account is banned. Virtual cards in “post-paid” (threshold billing) mode charge only for actual spend—remaining funds stay in your main wallet for other uses. Pitfall avoidance: New accounts should start with post-paid mode via virtual cards, switch to prepaid only after stability.

Summary: Virtual cards are like “bulletproof armor” for international Facebook ad accounts—low-cost experimentation, precise budget management, and strong protection against risks. Ideal for teams running multiple accounts or frequent creative tests.

Call to Action: Choose a reliable platform supporting multiple BINs (VISA/Mastercard) and instant issuance (like FotonCard or similar trusted providers such as PST.NET, Wallester, or Buvei), and start seamless ad spending today.